2020 has been a tough year for businesses, especially SMBs. Smaller firms, mainly from non-metro cities, had to up their game for sustenance in the pandemic wave.

Table of Contents

FY 2020-21 Roundup: How Accounting Software Supported SMBs Sustenance

However, digitally-enabled SMBs were in a comparatively better position than the others. A smarter approach to tech adoption and digitization helped them face the heat and put the best foot forward.

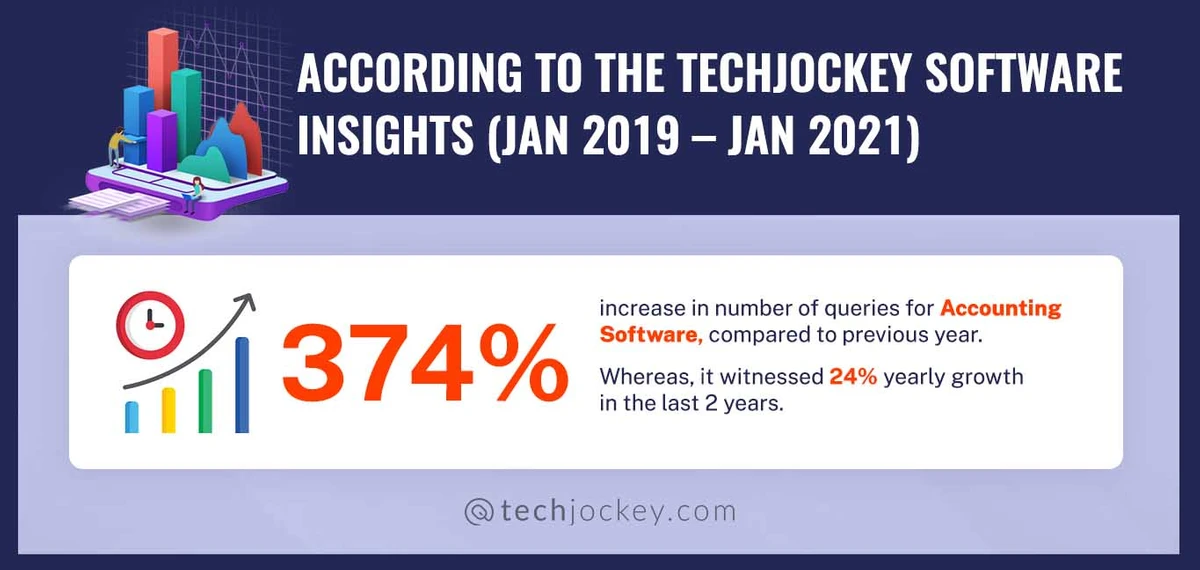

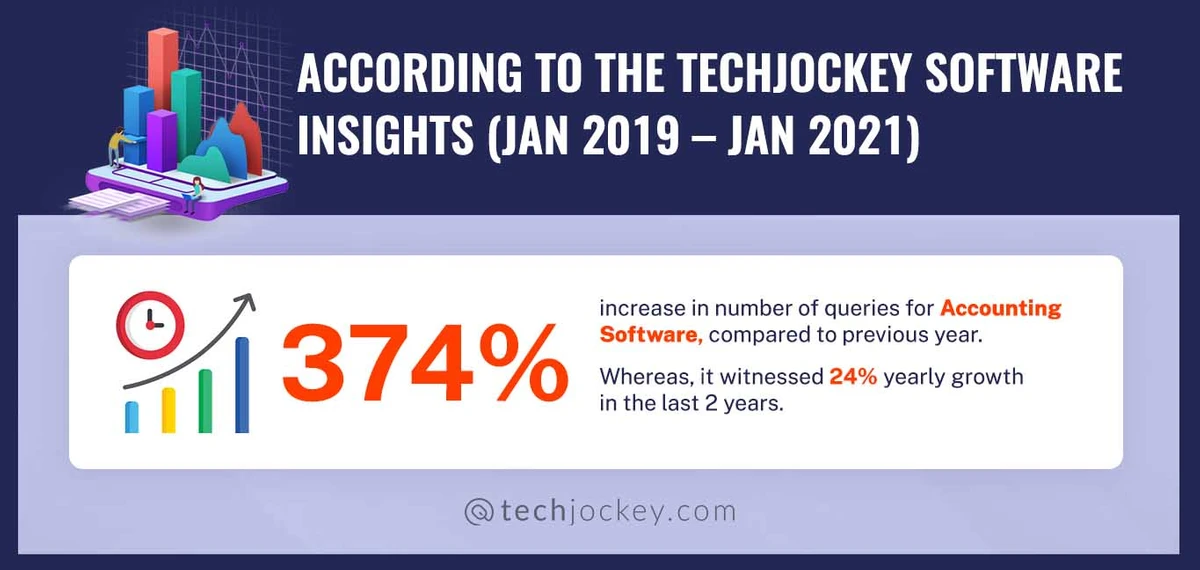

“In 2020-21, accounting software related searches saw a whooping surge with 374% increase in the number of queries compared to previous year. Whereas, it witnessed 24% yearly growth in the last 2 years.”

Software for Small Business: Not an Alien Terminology Anymore

Techjockey, India’s leading ecommerce platform for software and hardware, witnessed a striking increase by 374% in the number of queries for accounting software compared to a meagre 24% a year back in the fintech market.

This gives a fair understanding about how enthusiastic businesses are about scaling their growth by embracing technologies like small business accounting software, GST software and income tax software.

According to Techjockey Software Insights (Jan 2019 – Jan 2021)

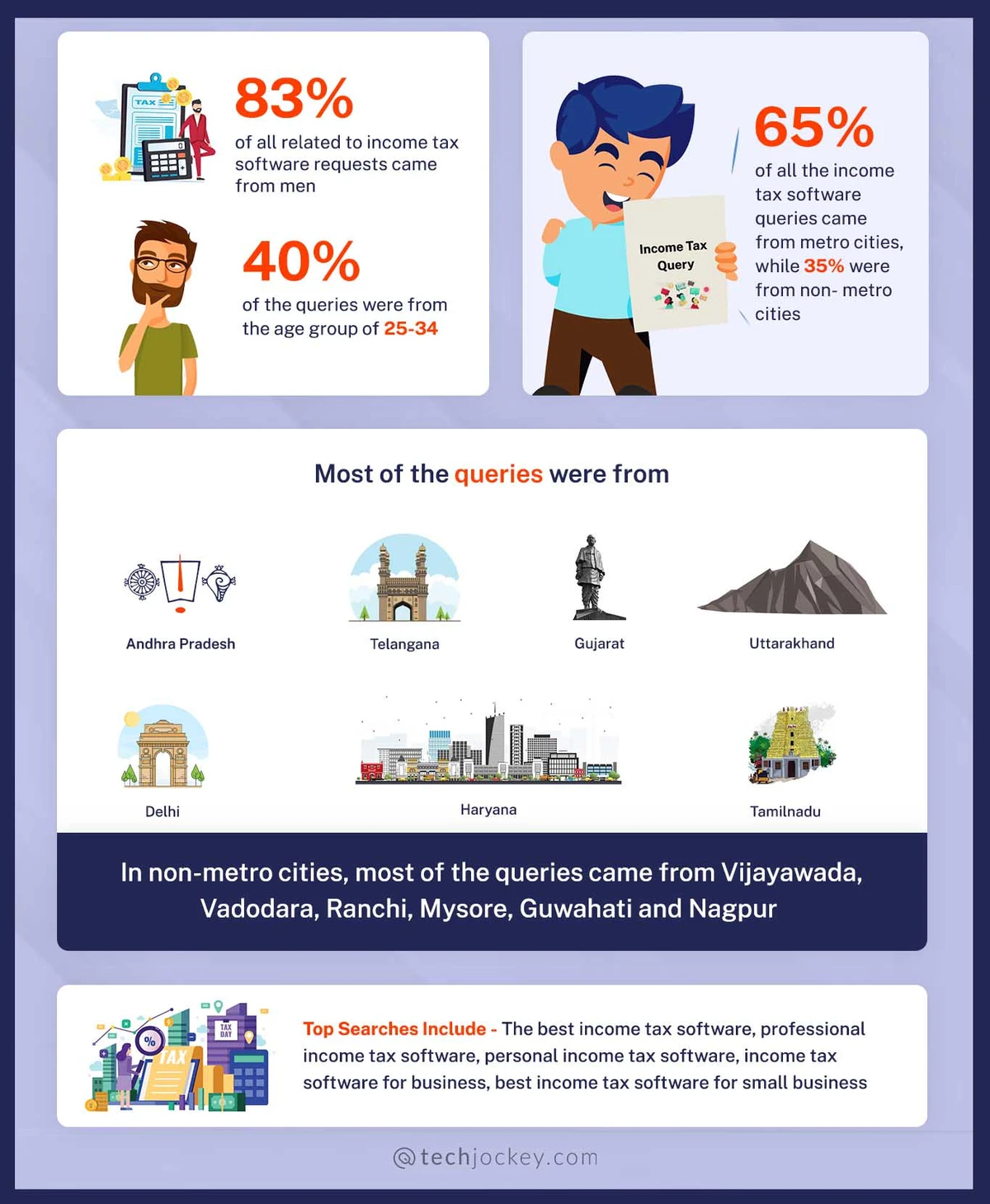

Queries regarding income tax software:

- 83% of all income tax software requests were raised by men.

- 40% of the queries came from the people in the age group of 25-34.

- 65% of the income tax software queries came from businesses operating in metro cities, while 35% were from other cities.

- Queries were majorly from states like Andhra Pradesh, Telangana, Gujarat, Uttarakhand, Delhi, Haryana, Tamil Nadu.

- In tier-II cities, queries were majorly from Vijayawada, Vadodara, Ahmedabad, Dehradun, Ranchi, Mysore, Guwahati, and Nagpur.

- Some of the most searched queries on google during this time were best income tax software for small business, professional income tax software, personal income tax software and income tax software for business.

IT solutions like GST accounting software and income tax software saw a major surge in demand among smaller businesses from tier II cities.

The COVID-19 pandemic saw more than 60 million SMBs in India enthusiastic about digitization and tech adoption. After all, this was pivotal to win customers amid chaos.

As per the queries received on the Techjockey platform, close to 65 percent of income tax software queries were made from metro cities. And rest of the queries were from SMBs in non-metro cities like Ranchi, Nagpur, Nagpur and Guwahati.

“Young entrepreneurs are more receptive to IT solutions and technology than Gen X or baby boomers.”

Some of the industries which observed a major boost in the FY 2020-21 were fintech, telehealth and edutech. Among these industries, the demand for software and IT solutions were quite higher than in previous years.

To encash the opportunity and to have better control over finances, businesses across these industries embraced automation technologies like accounting solutions.

Young Entrepreneurs: Understanding the Dramatic Impact of Digitization

Technology can enable entrepreneurship among the youth, and its effect is quite visible from the statistic mentioned above.

Moreover, a study conducted by UNCDF highlights that young entrepreneurs are adopting digital solutions overwhelmingly. The youth brigade in business finds IT solutions like data analytics software and accounting software quite useful for market trend forecasting and budgeting.

“Out of all the queries, 40 percent were placed by individuals in the age group of 25-34 years”

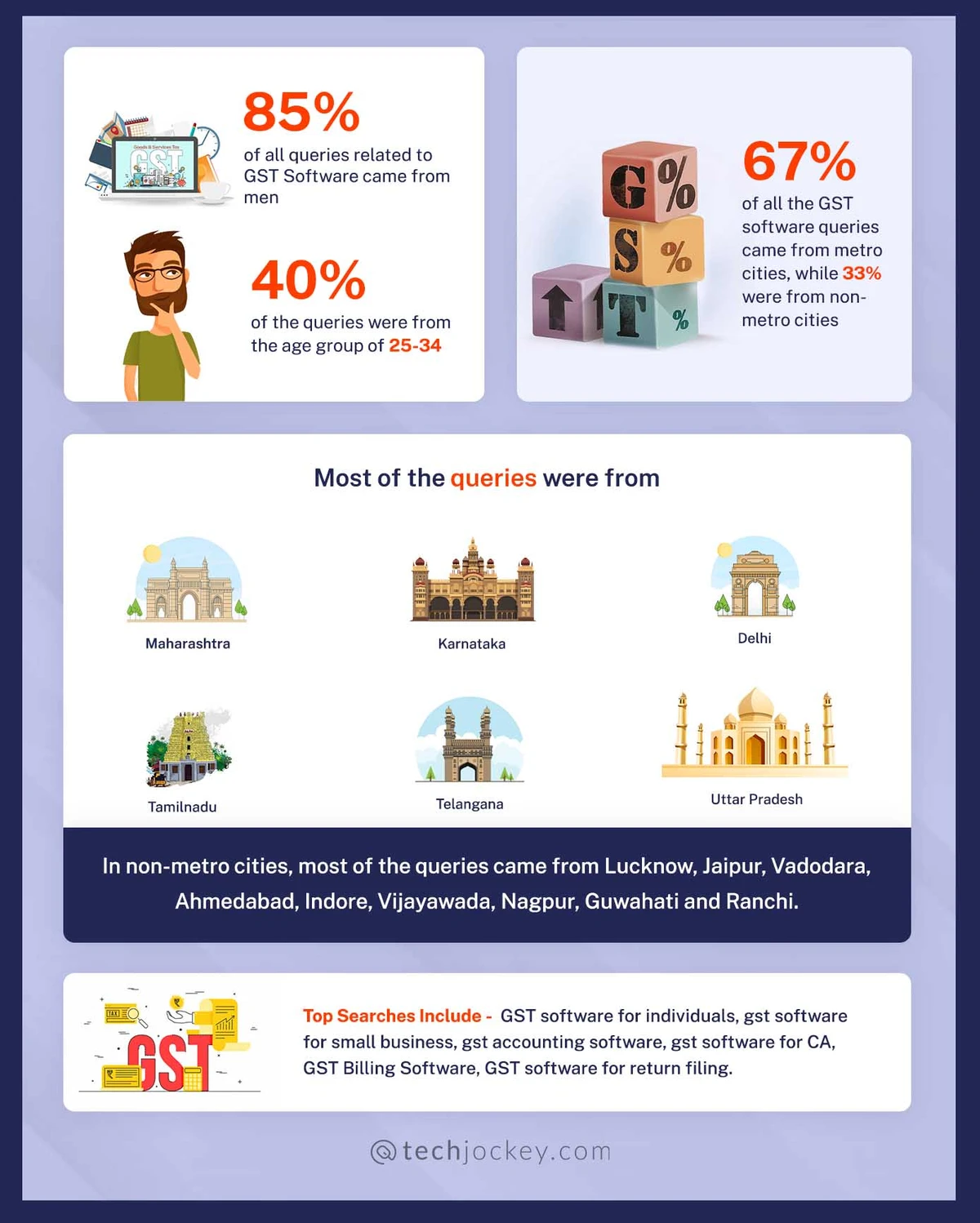

Another domain of research was GST software under accounting software. It sprang some surprising results upon us.

Queries regarding GST software:

- 85% of GST software related requests were raised by men.

- 40% of the queries were from people belonging to the age group of 25-34.

- 67% of GST software related queries were from metro cities, while 33% were registered from other Indian cities.

- These states ranked on the top for GST software related searches – Maharashtra, Karnataka, Delhi, Tamil Nadu, Telangana, Uttar Pradesh.

- In tier-II cities, most of the queries came from Lucknow, Ahmedabad, Indore, Vijayawada, Nagpur and Guwahati.

We witnessed a massive 85% of GST software requests coming from men. Again, 40 percent of GST software queries were made by individuals belonging to 25-34 years of age.

This demographic analysis further strengthens the statement made above that the young entrepreneurs are more receptive to IT solutions and technology than Gen X or baby boomers.

Some of the popular queries around GST software in the FY 2020-21 were GST software for individuals, GST software for small business, GST accounting software, GST software for CA, GST billing software and GST software for return filing.

Even those startups which are in the nascent stage are leveraging the power of technology for sustenance.

The Way Forward:

Sheela Nambiar, SMB Business Head at Oracle, said in an interview “Indian MSMEs are amongst the more progressive ones when it comes to embracing new technology initiatives,” As our insights also suggest, software solutions are playing the role of useful allies in the SMBs growth.

CA. Hemant Chansoriya, Finance Head at Techjockey, said “Accounting software is quite instrumental in the growth of our business customers who can manage finances automatically. Even those who are not an expert in accounting can manage all accounting operations with little training required”.

Ratnakar, a software enthusiast with 22 years of experience in Accounting said “Using Accounting software, it eliminates the overhead of a staff member and risk of manual data entry errors. Saves time and money for the business.”

View Complete Infographic of Accounting Software PDF for Accounting Insights FY 2020-21

Disclaimer: The insights report highlights evolving technologies and digital trends in the country. The information is analysed and aggregated at a level. We hope these findings better equip our software providers to understand queries patterns and address them effectively and help others become aware of their options when addressing their software solution needs.