We make it happen! Get your hands on the best solution based on your needs.

For Business

Saral TDS offers its services to any kind of business. It consists a very business-centric approach.

File e-TDS

The income tax software can provide access to GST portal directly from the software to file TDS online.

Generate Form-16s

The software can generate form-16 and several other tax-related documents for the employees and organization.

PAN Verification

Saral TDS offers online PAN card verification for better GST practices.

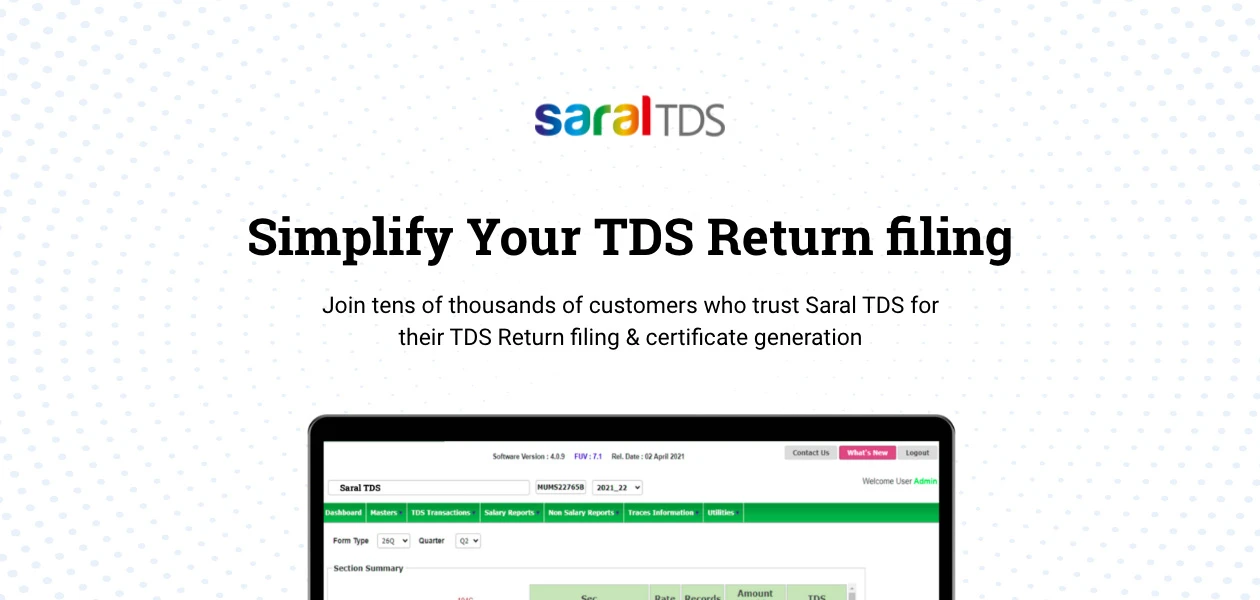

Complete Solutions For TDS

A single solution that meets all your needs for eTDS/eTCS filing with validation of details at required stages.

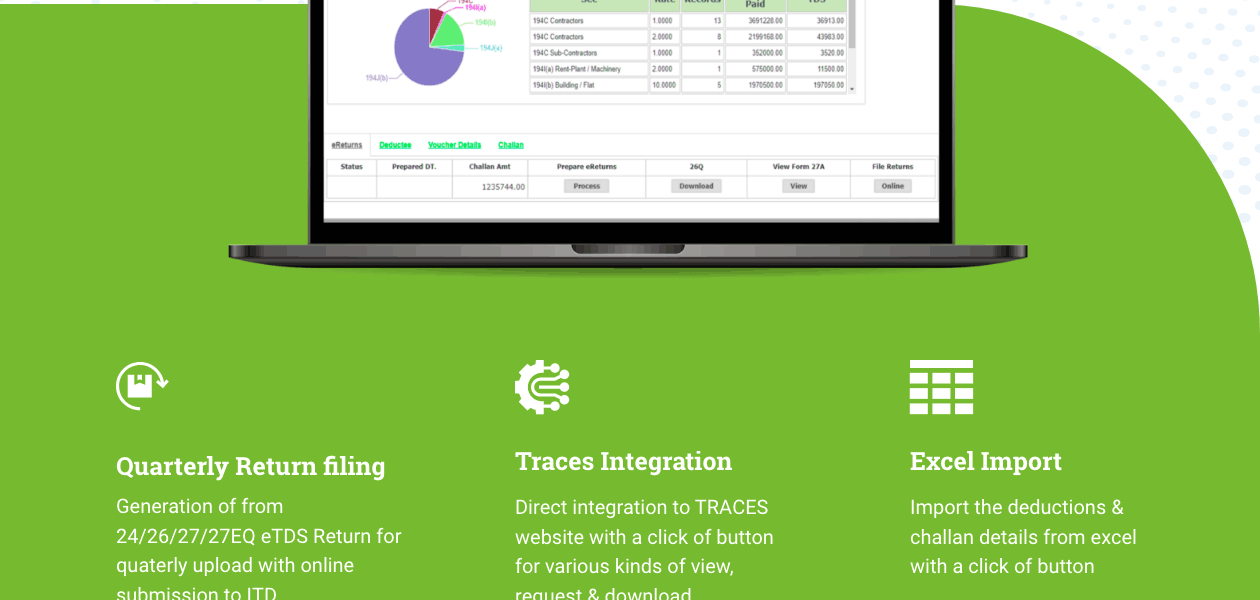

Fully Integrated With Traces

Easily port the details from Saral TDS to TRACES for various Request and Download options provided by TRACES.

Comprehensive Corrections

A very efficient correction module which will enable to prepare the correction return with ease.

Consolidated Form 16 & Form 16A

Form 16 and Form 16A can be directly downloaded to Saral TDS and generate into the required format in bulk with option to

Data Quality Report

A complete Report on the Data Quality of the Data entered and a report on the defaults that may arise after to filing the

Online Verification

Verify the PAN of the deductees & TAN of deductor against the ITD information, verify the Challan paid details against the

Detailed Tax Computation

Estimate the correct tax applicable for the employee and automatically deduct the TDS from the salary, every month on month,

MIS Reports

Business owners can get comprehensive management information reports on all their expense and tax-related workflows.

Have recommended this product

Overall Score

We love to hear from our buyers!

If you have used the solution

already, why not share your thoughts and help others make the right purchase.

Pros

“Saral TDS comes with a user friendly UI with all easily navigable format. For technical difficulty the live support is available to solve it.”

Rahul Kumar -

Jan 14, 2019

“I worked with John Sterle to identify a software system for our recruitment. John was courteous, professional and knowledgeable and we did sign up with his recommended company.”

SBS Chauhan -

Oct 7, 2016

Cons

“The company knows only to take money. After taking money they don't execute the orders & deliver the product.”

J V Prasad -

Jan 1, 2024

| Brand Name | Relyon Softech |

| Information | Relyon is providing high quality IT Products, solutions and services. |

| Founded Year | 2000 |

| Director/Founders | H S Nagendra |

| Company Size | 101-500 Employees |

| Other Products | Saral Accounts, Saral Billing, Saral Paypack, Saral TaxOffice, Saral IncomeTax |

20000+

20000+  Best Price

Best Price Free Expert

Free Expert 20 Lacs+

20 Lacs+