As per the report of DNA published in 2022, 51% of Indians are self-employed. The reason that most Indians are self-employed is because it offers people greater control over their work schedules, unlimited scalability, and direct benefits.

However, the biggest benefit of all when it comes to being self-employed is that people get to keep more of the money they make. For salaried individuals, the government takes a large chunk of their salary and only limited deductions are offered for savings and expenses. But self-employment income has huge tax benefits compared to salary, business, or rental incomes.

Government of India offers many self employment tax benefits & deductions to professionals and freelancers. This article will inform how you can make your self-employed business profitable by claiming, deductions, exemptions, and tax benefits.

Table of Contents

Who is a Self-Employed Person in India?

Before we get started with the taxation rules and exemptions for self-employed people in India, we need to understand who is considered as Self Employe inside the Union Territory of India.

Note: Self Employment is not exclusively defined as per the Income Tax Act 1961. However, there are a few points and mentions as per the Income tax act and rules, that hint at what could or could not be considered as Self employment.

- He/ she must be an individual

- A self-employed person is not bound by salary, incentive, or any other structured remuneration for an organization, business, or another individual

- He/she isn’t a part of an entity, organization, company, partnership firm, Hindu Undivided Family, etc

- Rental Income, Income on FD, sale of Fixed assets, or long-term contracts, isn’t considered self-employment.

- A person who should be trading or providing services on his own is considered as self Employed

- Self Employed people are taxed under the head “Profit and gain from Business or Profession” of Income Tax Act, 1961

- Any Profession including Doctor, author, dancer, musician, etc who is not employed by an entity is Self-employed

- A trader or service provider with the sole proprietorship of a shop or office is self-employed.

- A self-employed person isn’t governed or regulated by Acts and complicates like ESIC, EPF, Gratuity, and so on

Self-employed persons include shopkeepers, sole proprietors, contractors, lawyers, consultants, freelancers, artists, musicians, individual service providers, doctors (own clinic), and many other professionals.

What are the Benefits of Self Employment in India?

Here are some of the major benefits of being self-employed in India:

Flexibility: The biggest advantage of being self-employed is the ability to choose your own work hours. You can plan your day according to your priorities.

Unlimited Scalability: The scalability of self-employment is nearly unlimited. If you’re willing to work hard and put in the hours, there’s no reason why you can’t earn far more than you ever did as an employee.

Tax Benefits: When you’re self-employed, you can deduct the cost of your home office, your computer and phone, internet and cell phone service, business travel expenses, and more at the time of income tax calculation.

Easy Tax Returns: Income tax act offers a presumptive taxation option for small traders and professions under which they can assume a certain portion of their revenue as income and pay tax on it. No need to maintain the entire books of accounts.

Fewer Compliances: Self-employed individuals have fewer compliance requirements than those running partnership firms, agencies, or OPC.

Suggested Read: What are the Important Rules for Income Tax and IT Returns?

How to Calculate Self Employment Tax?

Here are some of the points you should know before getting into self employment tax calculations:

- Self-Employment tax is calculated as under: Income under the head “Profit or gains from Business and Professions” of Income Tax Act 1961

- The Income tax is charged based on regular slab rate of a resident individual (or) Senior Citizen (or) Super Senior Citizen (as applicable)

- Self-employed person is exempt from taxes up to ₹ 5,00,000 (with 87a Deduction)

- Although exempt, he/she should file income tax return if the yearly income exceeds ₹ 2,50,000

There are two major ways to calculate taxes: Tax on Net Total Income as per Books of Accounts and Presumptive Taxation.

Self Employment Tax on Net Total Income after Calculation

This is the standard way for calculating self employment taxes where taxes are charged on net profit plus income from other sources.

Total Profit = Total Revenue – All Expenses

Total Revenue

- Revenue: Income from Profession, sales, services, commission, brokerage, and other indirect Income.

- Revenue/ Income does not include Gifts, sales of assets, Interest, rental income, capital gains

Expenses:

- Cost of Goods sold, Overheads, direct expenses, materials, transportation cost, rent,

- Fuel expenses, meal expenses, home office expenses, travel expenses

- Depreciation on your laptop, printer, internet bill, mobile bill, etc

Tax on Presumptive Income

The Income Tax Act offers a presumptive taxation option for small traders and professionals under which they can assume a certain portion of their revenue as income and pay tax on it. There is no need to maintain entire Books of accounts if you choose this option.

Presumptive Taxation for Small Trader

- The one who sells things like retailers and shopkeepers.

- Total turnover/sales are less than 1 Crore in the whole financial year. (Roughly Rs 27,000 sales per day).

- Sales through digital wallets, UPI, and bank accounts assume a minimum 6% of total turnover as profit.

- Example: Total turnover 8o lakh (through digital transaction) the small trader can assume 6% of ₹ 80 lakh = ₹ 4.8 lakh as profit.

- Sales through cash and credit assume a minimum 8% of total turnover as profit.

- Example: Total turnover 8o lakh (through cash transaction) the small trader can assume 8% of ₹ 80 lakh = ₹ 6.4 lakh as profit

- For partly digital and partly cash transaction, the income should be calculated separately

- Example 50 lakh Digital Transaction and 30 lakh cash Transaction: presumptive income = 6% of ₹ 50 lakh + 8% of ₹ 30 lakh

- This is the minimum presumptive income that should be considered. Traders could assume higher than 6% or 8% of their total turnover as profit, if they think fit.

- Once you declare your total income…………………………………………………. on presumptive basis no further expenses are allowed foe deductions.

Presumptive Tax for Professionals

- For professionals like doctors, engineers, lawyers, CA, etc.

- Freelancers and service providers like writers, electricians, plumbers, etc.

- Gross income or total revenue should be Less than 50 Lakh in a fiscal year

- Minimum 50% of total revenue/fees/ charges should be assumed as income

- For example, if a doctor received a total of 20 lakh fees in a year, he should assume a minimum 10 lakh (50% of ₹ 20 lakh)

- No further deduction of expenses is allowed

- 50% is the minimum presumptive income that should be considered; professionals could declare income higher than 50% as they may deem fit.

Self Employment Tax Deductions Rules in India

- Deduction Under Section 80C up to ₹ 1,50,000

- Exemption of Interest Income up to ₹ 10,000 per year

- Deduction under section 87a (Rs 12,500)

- Deduction under 80D for medical Insurance up to ₹ 25000

- Deduction under 80E for interest on repayment of loan for residential house

- All other deductions under section 80E-80U

Note: The Standard Deduction of ₹50,000, which is allowed for salaried persons isn’t available for self-employed people.

Suggested Read: Best Free Income Tax Software for Tax eFiling, IT and TDS Returns

Income Tax Calculation Rules for Freelancers in India

- Any rental or interest income should be added separately after calculating the income from Business or Profession for the year

- All the allowed deductions should be reduced from the total income to calculate the total taxable Income

- Any exempted income is not added while calculating the total income

- The tax is then calculated Total taxable Income as follows:

Exempt Up to ₹ 5,00,000 (with deduction u/s 87a)

₹5,00,001 – ₹ 10,00,000: 20%

Above 10 Lakh: 30%

Self Employed Tax Returns Rules in India

Tax return needs to be filed by freelancers, professionals and other traders who are self-employed. Here are some of the major points that you need to consider while filing returns.

Date for Filing Tax Returns

- A financial year begins on 1st April of a year and ends on 31st March the subsequent year.

For Example, Financial Year 2022 begins on 1st April 2022 and ends on 31st March 2023

- The returns are filed only after the financial year ends, which is called the Assessment Year.

For example, For the financial year 2022, the assessment year begins on 1st April 2023. So, the tax returns for the FY 2022 would be submitted on in the assessment year i.e., after 1st April 2023

Applicable ITR Forms

There are basically two IT forms that a self-employed person can file based on certain factors: ITR 3 and ITR 4.

| ITR 3 | ITR 4 |

| Regular tax return for income under business or profession | Presumptive taxation for income under business or profession |

| All types of business and professions | Only if the annual turnover or receipt doesn’t exceed: ₹1 Crore for traders ₹50 Lakh for professionals |

| Actual income after all expenses | Minimum presumptive income 6% or 8% for traders (depending on mode of Transaction) 50% of gross receipts/fees |

| Could be used to declare losses | Not used to declare loss |

| Losses from previous years could be set off | Losses from previous year can’t be set off |

| Requires maintaining all books of accounts | Doesn’t require the submission of books of account details |

Summing Up: ITR Rules for Self Employed People in India

- Filing Return is mandatory if your yearly income exceeds ₹ 2,50,000

- Tax Audit is mandatory in case the gross Sales/ turnover exceeds 1 Crore for Traders (10 Crore if cash transaction volume is less than 5% of Turnover) and ₹ 50 lakh for professionals

- Filing Income tax return after due date u/s 139(4) might attract penalty depending on Total taxable Income

- Advance tax should be deposited in case your estimated tax liability is more than ₹ 10,000.

- You need to furnish all the details of assets, liabilities, capital, income and expenses in detail as per your Books of Account in case of ITR-3

- You only need to furnish estimates of capital, debtors, creditors, cash, and Bank balance, etc. in case of ITR-4

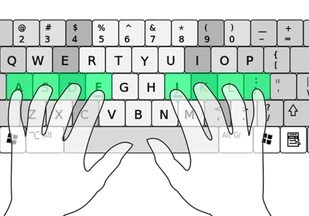

- You will need accounting software to maintain all your Books of Account if you intend to file ITR -3.

Suggested Read: Best GST Software for Secure Return Filing and Billing in India

How Accounting Software Helps Self Employed People?

Self-employed people have to maintain their accounts and file their taxes themselves. This can be a cumbersome and time-consuming process. However, accounting software can help self-employed people manage their finances more efficiently.

Accounting software can help self-employed people track their income and expenses, generate invoices, and manage their tax affairs. The software can also help them keep track of deadlines and make it easier to file their taxes on time.

There are many different types of accounting software available on the market. Some of the more popular options include QuickBooks, myBillBook, and FreshBooks. Freelancers should take some time to research the different options before choosing one that best suits their needs.

5 Tips for Beginners Using Income Tax Software

Conclusion

In conclusion, it is evident that the tax structure in India favors self-employment business over salaried individuals. This is especially pronounced when one looks at the exemptions available to self-employed people.

Even if you earn 30% less than a salaried person under a similar tax bracket, you can still have the same income as a self-employed person.

Related Categories: Income Tax Software | GST Software | Expense Management Software | Debt Collection Software | Accounting Software