(Tax Deducted at Source) TDS is one of the most common entries to be passed while receiving and making payment. It involves proper calculation, posting it in the right ledger, and reconciliation. In this post, we will guide you in passing TDS entry in Tally. We will provide practical examples for TDS Journal entry in Tally ERP 9 and Tally prime.

This tutorial aims to guide you through these topics:

- Basic explanation to TDS accounting and TDS entry

- Calculation of TDS deductible

- Creating TDS Ledger in Tally

- Making TDS Payable Entry in Tally

- Making TDS receivable entry in Tally

- TDS entry in Tally with GST

- Step by step journal entry of Tally in GST

Before we get into the steps of passing Tally entry of TDS, let’s understand the concept of TDS receivable and payable.

Note: If you exactly know about TDS, TDS rates, calculations and posting, you can directly jump to the Steps section.

Table of Contents

What is TDS (Tax Deducted at Source)?

Tax Deducted at Source (TDS) is a pre-tax deduction made at source (before payment) by the payer from the payment made to the payee. It is a mechanism of collecting tax by using a deduction mechanism rather than through payments made by the taxpayer. It is deducted at the time of payment, and directly deposited into the government (Income Tax Department’s) account.

There are generally two types of TDS in Books of Accounts: TDS Payable and TDS Receivable. We will understand both these TDS entries in Tally ERP 9 with examples.

Suggested Read: How to Record Sales & Purchase Entry in Tally with GST

TDS Payable

It’s the amount which you are required to deduct from the total payable amount to the service provider, contractor, professional, and then deposit to Income Tax department as tax on behalf of the payee.

It’s held on behalf of the Payee therefore it appears on the liability side of the balance sheet.

This must be confusing, let’s try to understand through a practical TDS example

Consider yourself as a hospital entity. Suppose you need to pay a sum of ₹1,00,000 to a doctor who provides professional medical services at your hospital.

Now as per the Finance Act, you should pay only ₹90,000 to the doctor after deducting ₹10,000 (at the rate of 10% on the total amount payable.) You need to deposit this 10,000 directly to the Income Tax department’s bank account on behalf of the doctor.

Note:

- The rate of 10% is for Professional services like medical and legal services under section 194J of the Income-tax Act. TDS deduction could be anywhere between 1% to 30% depending on the nature and number of payments to be made.

- ₹10,000 that is deducted would be considered as the amount paid by the doctor to the IT department. So, TDS is not your additional expense, but just a part of the payment that is diverted directly to the government, instead of the payee.

TDS Receivable

TDS receivable is the amount deducted by your customer, client, tenant, etc. from the total payable amount and is deposited to the IT department on your behalf.

TDS Receivable Example:

If you have rented out an office in your building to a bank at a rent of ₹80,000 monthly, you will only receive ₹72,000 in your bank account. ₹8000 will be deducted by the bank and will be deposited as tax paid to the IT department on your behalf.

Note:

- Rent payable on land and building attracts 10% flat TDS rate.

- The deducted amount is deposited to the Income Tax department on your behalf by the bank. It could be considered as the advanced tax paid by you.

Suggested Read: Guide on When and How to Use Tally Shortcut Keys List

Calculation of TDS

Although it’s quite simple, there might be confusion related to TDS calculation. TDS deductible amount should be accurately calculated while making payments. Here are the major things that you need to consider while calculating TDS.

- TDS deductible should be calculated on the total amount payable to the deductee.

- TDS Deductible is calculated as per the rates prescribed by Income Tax.

- For Assessment Year 2023-24, here are the TDS Rates:

- Salary- As per Tax Slab

- Rent on Land and Buildings: 10%

- Professional Fees: 10%

- Individual Contractor: 1%

- In case, the TDS needs to be deducted for services where GST is applicable, TDS is calculated on the taxable value of supply and not on the total payable amount. (Discussed this part in the later entry with example.)

- If part payment is to be made, then TDS will be calculated only on the partly payable amount but not on the entire amount.

Steps for TDS Entry in Tally ERP 9

Now, let’s understand the entries made in Tally for TDS. As we have talked, there are two types of TDS entries that you need to make: TDS Payable and TDS Receivable.

TDS Payable Entry in Tally with Example

According to standard Accounting Practice, TDS Payable is passed by three different entries.

- The first entry is passed while booking TDS payable and the total amount payable to the deductee.

- The second entry will mention the exact amount through bank/ cash to the deductee.

- The third TDS entry is passed when TDS payable is deposited in the account of the Income Tax Department.

Practical TDS Payable Entry Example

If ₹50,000 for as contract is payable to Mr. X after deducting TDS at 10%.

- The first entry is when the TDS is booked along with amount payable to the Payee

| Contract Expenses A/c Dr | 50,000/- |

| To Mr. X A/c | 45,000/- |

| To TDS Payable A/c | 5,000/- |

- The second Entry would be made while paying the amount to the Payee

| Mr. X A/c Dr | 45,000/- |

| To Bank A/c | 45,000/- |

- Third Entry when TDS Deducted is paid/deposited to the IT department’s Bank Account

| TDS Payable A/c Dr | 5,000/- |

| To Bank A/c | 5,000/- |

Steps For TDS Payable Entry in Tally ERP 9 (Same for Tally Prime)

Here are the steps you need to follow for Tally ERP TDS payable entry:

- Create TDS Payable Ledger First (Skip if already created)

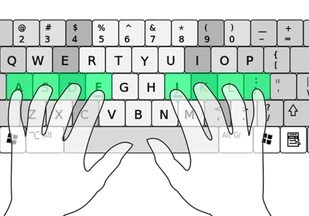

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounts info” info or press “A”

Step 3: Go to “Ledgers” or press “L” on keyboard

Step 4: Choose Create option or press “C” on keyboard

Step 5: Write “TDS Payable” on name field.

Step 6: Choose “Current Liabilities” as the group

Step 7: Simultaneously Press Ctrl+A and save the ledger.

- Pass Journal Entry to Book TDS Payable in Tally

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or press “V”

Step 3: Press “F7” on keyboard to pass journal entries

Step 4: Enter expense ledger for expenses you are booking (Rent, Contract, Professional Fee)

(Or)

Press “Alt +C” to create a new expense ledger

Step 5: Input the total amount payable before TDS deduction and press “Enter”

Step 6: Select the Payee whom the amount is to be paid

(Or)

Press “Alt +C” to create a new ledger

Step 7: Press “Enter”

Step 9: Input the amount after TDS Deduction and press “Enter”

Step 10: Select “TDS Payable” account and input the TDS amount

Step 11: Enter Narration (Optional)

Step 12: Press “Ctrl +A” to save the journal voucher

Suggested Read: How to Create Ledger in Tally Prime

- Payment Entry when the Amount is Actually paid

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or Press “V”

Step 3: Press “F5” on keyboard to pass payment entries

Step 4: Select the payment account (Bank, Cash, etc.)

Step 5: Select the payee whom the amount is to be paid

Step 6: Enter the net amount paid to the payee

Step 7: Press “Ctrl +A” to save the journal voucher

- Entry when TDS Payable amount is deposited

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or press “V”

Step 3: Press “F5” on keyboard to pass payment entries

Step 4: Select the payment account (Bank, Cash, etc.)

Step 5: Select the “TDS Payable”

Step 6: Enter the net amount deposited

Step 7: Press “Ctrl +A” to save the journal voucher

TDS Receivable Entry in Tally with Example

TDS receivable entry is generally booked in two parts.

- First one when the bill is issued to the party.

- The second one is when the net payment after TDS deduction is received from the party.

Practical TDS Receivable Example

Your company sent out the bill of ₹35,000 for contract to XYZ private limited. The payment was received after the deduction of TDS at 10%.

- The first entry is when the total amount receivable from the party is booked

| XYZ Pvt LTD A/c Dr | 35,000/- |

| To Revenue A/c Cr | 35,000/- |

- The second entry is passed to book TDS receivable when net amount is received in bank. This is done through Two different entry

Receipt Entry

| Bank A/c Dr | 31,500/- |

| To XYZ Pvt Ltd | 31,500/- |

Journal Entry

| TDS Receivable A/c Dr | 3,500/- |

| To XYZ Pvt Ltd A/c | 3,500/- |

Steps For TDS Receivable Entry in Tally ERP (Same for Tally Prime)

Here are the steps you need to follow for Tally ERP TDS receivable entry

- Create TDS Receivable Ledger (Skip if already created)

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounts info” Info or Press “A”

Step 3: Go to “Ledgers” or press “L” on Keyboard

Step 4: Choose Create option or press “C” on keyboard

Step 5: Write “TDS Receivable” on Name Field.

Step 6: Choose “Current Assets” as the group

Step 7: Simultaneously Press Ctrl+A and save the ledger.

Suggested Read: Depreciation Entry in Tally Prime and ERP 9 (with Examples) 2023

- Pass Journal Entry to Book Income in Tally (when Bill is issued)

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or press “V”

Step 3: Press “F7” on keyboard to pass journal entries

Step 4: Enter the customer/ client account to whom the bill is issued

(Or)

Press “Alt +C” to create a new customer/client ledger

Step 5: Input the total amount receivable before TDS deduction and press “Enter”

Step 6: Enter revenue ledger for income you are booking (Professional, Contract, etc.)

(Or)

Press “Alt +C” to create a new ledger

Step 7: Press “Enter” twice

Step 8: Press “Ctrl +A” to save the journal voucher

- TDS Receivable Entry when the Amount is received

You need to pass two entries to book TDS receivable

Payment Entry

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or press “V”

Step 3: Press “F6” on keyboard to pass receipt entries

Step 4: Select the receipt ledger (Bank, Cash, etc.)

Step 5: Select the party from whom the amount is received

Step 6: Enter the net amount received from the client/customer

Step 7: Press “Ctrl +A” to save the journal voucher

Suggested Read: Step By Step Interest Calculation in Tally (Simple & Advanced Mode)

TDS Receivable Booking

Step 1: Open “Gateway of Tally”

Step 2: Navigate to “Accounting Vouchers” info or press “V”

Step 3: Press “F7” on keyboard to pass journal entries

Step 4: Select the “TDS Receivable” ledger

Step 5: Input the total amount deducted as TDS and press “Enter”

Step 6: Enter customer/client ledger

Step 7: Press “Enter”

Step 8: Press “Ctrl +A” to save the journal voucher

TDS Entry in Tally with GST

Whenever you must make a Tally entry for TDS with GST, the entire process remains the same except the fact that TDS is only deducted on the taxable value component not on the GST component. Else, the entry will remain the same as above.

Here is a TDS entry in Tally ERP 9 GST with an example

If your company avails ₹1,00,000 services from a website designing agency and the agency charges 18% GST on the total value of contract. The total value payable would be ₹1,18,000.

The TDS deductible would be ₹10,000 (10% of ₹1,00,000). TDS would not be deducted from GST component i.e., ₹18,000

The entry would be as follows:

| Expense A/c Dr | 1,00,000/- |

| CGST ITC A/c Dr | 9,000/- |

| SGST ITC A/c Dr | 9,000/- |

| To Agency A/c | 1,08,000/- |

| To TDS Payable A/c | 10,000/- |

Note: The entry should be passed as a journal voucher in Tally ERP 9 and Tally Prime.

Suggested Read: What is the Purpose of Financial Management in Tally?

FAQ

- Under which group is TDS ledger created in Tally?

TDS ledger should ideally be created under Duties and Taxes Group in Tally. However, it could be created under Current Asset and Current Liability for better representation on balance sheet. TDS receivable should be under Current Asset and TDS payable under Current Liability for better representation.

- Is TDS an asset or liability?

TDS receivable is considered as an asset while TDS payable is considered as liability.

- Is TDS calculated on GST component?

No, TDS is not calculated on GST component. TDS is only calculated on the taxable value of the service or charges but not on the GST component.

- Is TDS payable an expense?

TDS payable is the amount deducted from total payment to be made to the payee. Since it’s a part of salary, contract or professional expense, it is deemed to be expense. However, TDS payable is not accounted separately as an expense, as it's already booked when the expense is due.

Related Categories: Accounting Software | GST Software | Income Tax Software | Expense Management Software | Financial Management Software