Summary: In this article, you can explore the concept of Loss of Pay (LOP) and the way it is calculated. LOP is when an employee takes leave without sufficient leave balance and experiences a deduction in their salary. The calculation typically involves multiplying the number of leaves taken by the employee with their daily wage.

Table of Contents

What is LOP (Loss of Pay)?

LOP, or Loss of Pay, refers to a situation where an employee takes leave from work but does not receive their regular salary or wages for that period. LOP can occur for various reasons, such as personal leave, medical leave, sabbatical, maternity or paternity leave, or any other approved absence from work.

During this time, an employee may need to use their paid leave entitlements, such as vacation or sick leave, or they have to take unpaid leave if they have exhausted their paid leave balances. It can have an impact on an employee’s overall compensation and should be considered when planning for leave.

Factors Counting for LOP In Salary

Loss of Pay can occur with an employee for various reasons. Here are a few factors that contribute to LOP:

- Absence from Work: If an employee takes uninformed leave from work, such as personal leave, vacation leave, sick leave, or any other approved absence, they might experience LOP for the duration of their absence.

- Exhaustion of Paid Leave: If an employee has utilized all their paid leave entitlements, such as vacation days or sick leave, and continues to take leave, the additional time off might result in LOP.

- Unapproved Leave: Taking leave without any proper approval from the employer or not adhering to the established leave policies can lead to LOP. Unexcused absences result in deductions from the employee’s salary.

- Partial-Day Leave: In some cases, taking partial-day leave might result in LOP for the portion of the day that the employee is absent from work.

- Extended Leave: Long-term leaves, such as sabbaticals, maternity, paternity leave, or extended medical leave, might result in LOP beyond the employee’s available paid leave. In these cases, the employee might need to take unpaid leave, contributing to the loss of pay.

- Company Policies: Each company has its own policies and loss of pay leave rules. It’s essential for employees to be aware of these policies and understand the impact on their salary in case of leave.

The loss of pay calculation and its impact on an employee’s salary can vary depending on various factors, including employment laws, company policies, and individual employment contracts.

Type of Leaves in the Indian Payroll System

In the Indian payroll system, employees are offered various types of leaves to ensure a proper work-life balance and cater to their personal needs. These types of leaves include:

- Sick Leave: Sick leave is provided to employees who are unwell and unable to attend work. The duration of paid sick leave varies among organizations, and some even require a medical certificate for prolonged absences to prevent misuse of sick leave.

- Casual Leave: Casual leave allows employees to take time off for personal reasons such as vacations, family events, or personal commitments. The number of casual leave granted per employee usually depends on the organization’s leave policy and can range from one to two days per month or eight to fifteen days per year.

- Maternity Leave: Maternity leave is an important provision for female employees in India. As per the Maternity Benefit Act, women are entitled to 26 weeks of maternity leave before and after childbirth. During this period, they receive their full salary. The duration might be extended for certain medical conditions related to pregnancy.

- Paternity Leave: Paternity leave is granted to male employees who have become fathers. In India, male employees are entitled to 15 days of paternity leave, which can be taken towards the end of the pregnancy or within the first six months after childbirth. However, paternity leave is not yet widely offered by all organizations.

- Earned Leave or Privilege Leave: Earned leave, commonly known as privilege leave, is earned by employees based on their length of service. The number of earned leave days an employee can avail of typically increases with their tenure in the organization. These leaves are fully paid, and employees usually have the option to carry forward their unused leave or get it encashed at the end of the year.

- Study Leave: Study leave, or sabbatical leave is granted to employees who wish to enhance their skills or pursue further education. It is usually a long-term leave and is either paid or unpaid depending upon company policies.

Apart from these types, there are other leaves that employees might be eligible for, such as bereavement leave for when there is a death in the family, marriage leave, quarantine leave, or special leave for specific circumstances or events.

Types of Holidays in India

In India, various types of holidays are observed throughout the year. These holidays hold cultural, religious, and national significance and are celebrated across the country. Here are some of the types:

- National/ Gazetted Holidays: National holidays are celebrated across the country to remember important events in Indian history. These holidays include Independence Day, Republic Day, Gandhi Jayanti, etc.

- Religious Holidays: India is known for its rich cultural and religious diversity, and several religious holidays are observed by specific communities. These holidays include Diwali, Eid, Christmas, and many others.

- Restricted Holidays: In addition to national holidays, there is a list of restricted holidays in India. These holidays allow individuals to choose additional days off based on their own religious, cultural, or personal preferences. The number of restricted holidays can vary from organization to organization, and individuals can select holidays that align with their beliefs and traditions.

- Public Holidays: Public holidays are days when government offices and banks remain closed, but private organizations may or may not follow the same holiday schedule. Public holidays include both national holidays and regional holidays, depending on the location.

How to Calculate LOP In Salary?

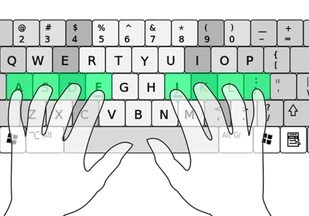

To calculate LOP (Loss of Pay) in salary, you need to follow these steps:

- Determine the employee’s basic salary per month: This is the fixed amount that the employee earns for his/her services monthly.

- Determine the number of days for which the employee is absent: LOP is usually applied when an employee is absent from work without any valid reason or informed leave. You will have to count the number of days for which the employee has been absent.

- Calculate the daily rate of the employee: Divide the basic salary by the total number of working days in a month to get the daily rate. For example, if the basic salary is INR 30,000 and there are 30 working days in a month, the daily rate would be INR 1,000.

- Calculate the LOP amount: Multiply the number of days of absence by the daily rate. For example, if the employee was absent for 2 days, the LOP amount would be 2 (days) multiplied by INR 1,000 (daily rate) = INR 2,000.

- Deduct the LOP amount from the employee’s salary: Subtract the LOP amount from the employee’s basic salary to calculate the final salary after applying LOP.

What is Leave Encashment?

Leave encashment is a practice where employees receive monetary compensation for their unused leave days during their employment. It allows employees to exchange their accrued and unused leave days for cash. The eligibility for leave encashment varies by organization, often requiring a certain period of service.

The calculation of encashed leave typically involves the employee’s basic salary or a predetermined formula set by the organization. Tax implications are also taken into consideration, and it is recommended to consult with the HR department or tax experts for specific details.

Leave encashment policies differ across organizations, so it’s important to refer to the specific policies and guidelines set by the employer.

How to Avoid LOP in Your Salary Slip?

To avoid LOP (Loss of Pay) in your salary slip, you can follow these steps:

- Be aware of company policies: Familiarize yourself with your organization’s policies regarding leaves, attendance, and LOP. Understand the rules and procedures related to applying for leave, submitting leave requests, and any specific requirements for taking time off.

- Plan your leaves in advance: Whenever possible, plan your leaves in advance and submit leave requests according to the company’s procedures. This ensures that your absence is recorded as authorized leave and helps avoid unauthorized leave or instances of absence without a valid reason.

- Utilize your available leave balance: Make use of your available leaves throughout the year. Take periodic breaks or vacations to maintain a healthy work-life balance while utilizing the leave allowance provided by your organization.

- Communicate with your supervisor/manager: Maintain open communication with your supervisor or manager regarding your leave plans and any unforeseen circumstances that may affect your attendance. Inform them in advance if you anticipate the need for time off or if any emergencies arise.

- Follow leave approval procedures: Ensure that your leave requests are properly submitted, approved, and documented according to your company’s procedures. This helps to avoid any misunderstandings or discrepancies in the recording of your leave.

Remember, every organization has different policies and procedures regarding leaves and LOP. It’s important to familiarize yourself with your company’s specific guidelines and consult with your HR department if you have any questions or concerns.

Conclusion

In this article, we explored the concept of Loss of Pay (LOP) and how it affects an employee’s salary. LOP occurs when an employee takes leave without a sufficient leave balance, resulting in a deduction from their salary. Factors contributing to LOP include absence from work, exhaustion of paid leave, unapproved leave, partial-day leave, and extended leave.

The specific calculation and impact of LOP on salary can vary depending on employment laws, company policies, and individual contracts. To calculate LOP, steps such as determining basic salary, calculating the number of absent days, finding the daily rate, and deducting the LOP amount from the salary need to be followed.

FAQs

- What is the difference between loss of pay and leave without pay?

When an employee lacks sufficient leave balance but receives approval from the employer for their leave request, it is known as leave without pay (LWOP). During LWOP, the employee is on an unpaid leave of absence. In cases of Loss of Pay (LOP), the employee's absence may or may not be approved by the employer.

- How do you keep track of time and attendance virtually?

To keep track of time and attendance virtually, companies can use different approaches. Some common approaches include using time tracking software or apps where employees can log their hours worked, using virtual punch-in and punch-out systems, or utilizing video conferencing tools to host virtual team meetings where attendance can be recorded. Implementing these virtual solutions helps companies accurately track employees' time and attendance even when working remotely.

- How is the leave encashment calculated? When is it paid?

Leave encashment is calculated based on an employee's accrued unused leave days at the time of their departure or as per the company's policy. The calculation usually involves multiplying the number of unused leaves with the employee's daily wage. The payment is typically made during the final settlement process when an employee leaves the organization or as per the company's specific policy on leave encashment.

- Is LOP deducted from basic salary?

Loss of Pay (LOP) is typically deducted from an employee's salary, but the specific rules vary depending on the company's policies and employment laws. However, in most cases, LOP is deducted from the basic salary component of the employee.

- What is LOP full form?

LOP stands for Loss of Pay. It refers to a situation where an employee's salary or wages are reduced due to absence from work, usually when they have exhausted their available paid leave. LOP can occur for various reasons such as personal leave, unpaid leave, or disciplinary actions. The employee does not receive their regular income during this period.