What is Income Tax Software?

Income Tax Software is a comprehensive solution for Indian tax compliance that automates ITR preparation, TDS returns, and online filing in bulk. It is widely used by CA firms, Law firms, and tax practitioners.

It assists with income tax computation and calculation, TDS and ITR filing, and compliance management according to income tax laws. It helps with data entry, return preparation, client management, deadline management, reporting, and more.

This software facilitates easy preparation and e-filing of ITRs by automatically filling out pre-validated clients' information, income details, deductions, exemptions, and so on.

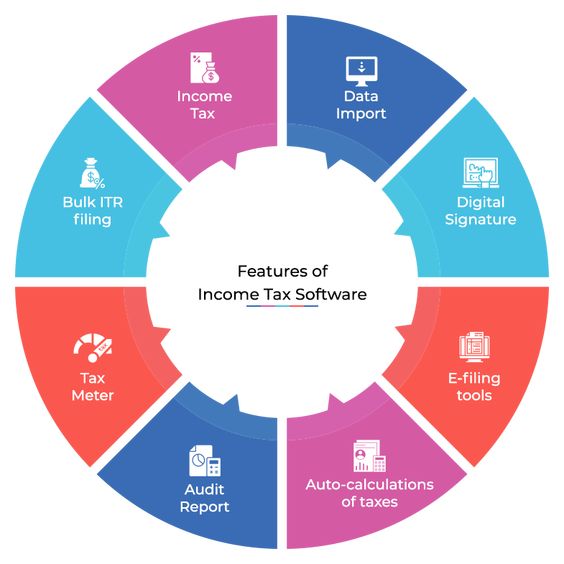

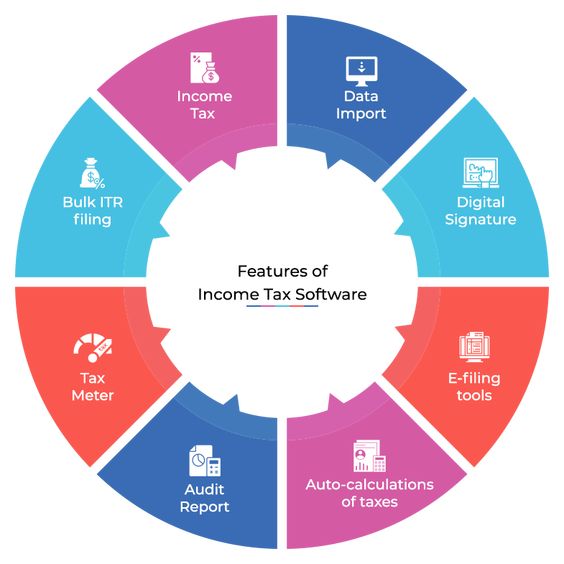

Most Common Features Of Income Tax Software

Income tax software comes with features like a tax planner, bill management, and income tax checker to streamline the tax filing process. Additionally, it also lets you calculate complex tax calculations for accurate returns filing. Here are some other common features that you get with this software:

- Online Income Tax: Cloud-based income tax software helps access a dashboard and track financial details anywhere and anytime.

- Bulk ITR Filing: With corporate income tax software, you can easily file income tax returns in bulk with support from E-Return Intermediary services.

- Tax Meter: Professional income tax software has a metering feature that looks at numbers under different income categories to check the interest payable.

- Auto-Calculation of Taxes: Computation of income and exceptions for all categories can be calculated automatically with the help of income tax calculation software.

- Auto-Estimation: Estimation of late payments, payment interests, late filing interest, and the fee for delayed filing can be done automatically with the help of income tax software.

- Audit Report: Income tax return filing software has a built-in module for creating audits with easy importing. You can also auto-transfer computation and ITR and save the relevant data for future use.

- Reporting: You can generate various reports like challan, MIS, and computation reports duly signed by the auditor.

- Data Import: You can bulk import data from multiple sources such as XML, Excel, and more for filing income tax returns.

- Tax Details Import: Tax details paid in previous financial years can be extracted with the income tax software. You can get details like TDS, 26QB, and 26QC from Form 26AS.

- e-Filing Tools: You will get an e-return to submit ITR and an e-return error locator utility. You can also update your e-filing profile with e-filing software.

- Online Adhaar-PAN Linking: Functions like e-challan, mass e-return processing status, and online Adhaar-PAN linking can also be done with ITR filing software. You can also download and import XML and other file formats from the IT website.

- E-Services: Income tax filing software can guide you with e-payment, submission of payment details, message services, digitally signed e-invoice, and auto-registration on formatting and surrendering license.

- Add Digital Signature: You can upload your digital signature using the digital signature utility feature for Form 16 and Form 16A.

- Integration with TRACES: The best ITR filling software provides utility features fully integrated with TRACES (TDS Reconciliation, Analysis, and Correction Enabling System).

Modules of Income Tax Software

There are different types of modules available in taxation software to manage tax-related procedures including Tax Calculation, Income Tax Return Filing, Client Management, Tax Planning, Asset Management, etc. Here is the detailed enumeration of each of them:

- Tax Calculation Module: The tax calculation module helps compute a client's net payable tax as per the Income-tax Act. It calculates income tax for salaried, professionals, businesses, companies, trusts, firms, HUFs, and all other entities according to slab rates.

- Income Tax Return Filing Module: The e-filing module helps in filing ITRs (Income Tax Returns) electronically. It also helps in filing TDS (Tax Deducted at Source) & advance tax returns and creating e-TDS & e-TCS statements.

- Client Management Module: The client management module helps maintain records of all clients, their return filing dates, PAN numbers, contact information, ITR types, etc. It also sends automatic reminders to clients for filing their taxes and keeping them updated about the latest tax changes & amendments.

- Anticipatory income tax calculation: This module is used for projecting or estimating the income and tax payable for the future financial year. Anticipatory income tax software is beneficial for making investment decisions, planning tax liabilities, and budgeting.

- Tax Planning Module: The tax planning module assists in planning the client's tax liability and making investment decisions accordingly. Income tax planning software considers various deductions and exemptions available under the Income Tax Act.

- Asset Management Module: The asset management module enables you to track all client assets, such as property, investments, jewelry, cars, etc. It also helps in computing LTCG, STCG, depreciation and charge indexation on the sale of assets.

- Compliance Module: The compliance module helps in maintaining records of all the compliances to be done by a client, such as filing ITR, slab rates, indexation, audit requirements, furnishing TDS return, a deposit of advance tax, etc. It also sends automatic reminders to the client for compliance due dates.

- Refund Management Module: The refund management module helps compute the refund amount due to a client. It considers the TDS deducted, advance tax paid, and tax payable. It also helps in filing refund applications and tracking the status of refunds.

- TDS Calculation and filing Module: The TDS calculation and filing module helps compute the TDS amount to be deducted by the company while paying salaries and other remunerations. It also helps in filing TDS returns and generating TDS certificates.

Who Uses Income Tax Software?

Different segments of professions/organizations use income tax software to calculate and track their taxes.

- Chartered accountants / CA firms: Most of the CA firms in India use income tax computation software to manage their clients' taxes, due dates, compliances, and payments in a better way. This income tax software for chartered accountants helps with easy, fast e-filing of their client's income tax.

- Law firms: Law firms need income tax software to manage their clients, TDS returns, advance taxes, pending cases, etc.

- Small businesses: Small businesses need to keep track of their finances, expenses, revenue, and assets to properly calculate their profits, taxes, and advanced tax payables. Best income tax return software for small businesses helps comply with the Income Tax Act 1961.

- Self-employed: Self-employed individuals must maintain records of their income and expenditure to file their taxes correctly. They can use the best income tax software for self-employed to keep track of all their financial transactions and automatically compute their taxes.

- Senior citizens and pensioners: Senior citizens and pensioners need to track multiple incomes, including their pension, interests, income from house property, agricultural income, and other sources. Income tax calculation software for pensioners helps them to calculate the total taxable income and income taxes to be paid or refund to be claimed.

- Auditors: Internal and external auditors also use income tax return software to review their client's financial records to ensure compliance with income tax laws.

- Teachers: Taxation software for teachers helps them to calculate the total taxable income, TDS Deducted, and income taxes to be paid or refunded to be claimed.

How to Use Income Tax Return Filing Software?

Income tax filing software is designed to help taxpayers correctly and efficiently file their taxes. Most IT software solutions are deployed on-premises, while some are web-based. Here is how ITR filing software works:

- Download /Install the software or sign in on the Web Portal.

- Fill in the personal or company details (PAN Card, DOB, DOI, etc.)

- Provide the existing Financial Statement details (Balance Sheet, P/L account, Assets)

- Enter the Income details (Incomes from Salary, House Property, Capital Gains, Business and Profession, etc.)

- Deductions & Exemptions (Section 80 C, 80 D, 80 E, etc.)

- Add Investments & Expenditures

- Enter the TDS and TCS amount from AS

- File Returns

CA Firms and tax practitioners can manage file returns by creating multiple client databases.

How Does Income Tax Software Help with TDS and ITR Filling?

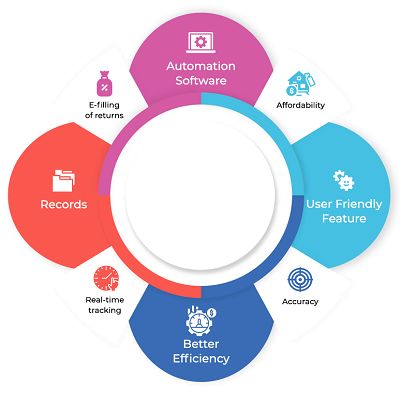

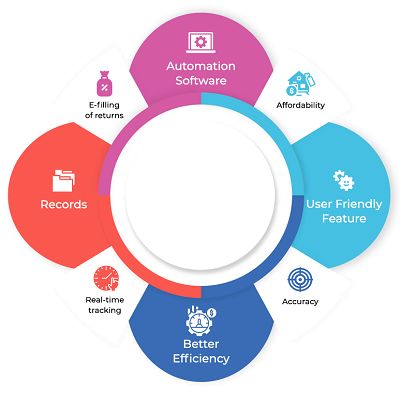

There are a lot of benefits to using taxation software. Be it automation, increase in efficiency or accuracy, bulk filing, or record management. Let's have a look at the benefits of this software below:

- Automation: Automation is a major boost in taxation software. It reduces manual efforts, as it can automate taxation formalities, from tax calculation to tax filing. Income tax computation software will help you in your accounting process for calculating income tax, advance tax, wealth tax, and TDS (Tax Deduction at Source).

- Compliance management: Income tax compliance software not only helps with automated tax calculation but can also keep track of changes in tax laws to ensure compliance. This is beneficial for businesses with multiple locations or those that are required to comply with multiple laws.

- Auditing: Income tax audit software can help by providing a comprehensive view of all the transactions related to income tax, which is extremely helpful in internal, tax, and state audits.

- Accuracy: Manual calculations always have the risk of going inaccurate. Income tax software will assure you of accurate results that can be trusted for your income tax filing purposes. This reduces manual labor, saves time, and reduces the chances of human error within your organization.

- e-Filling of Returns: A taxpayer should follow a prescribed format to have undisputed accounts, whether an individual or an organization. After calculating the tax amount, the income tax return filing software will take care of all these pre-defined formalities. Thus, you don't need to worry about any discrepancies.

- Records: Taxation requires you to maintain records so you can get the required details at any time without digging deep into the paperwork. Income tax filing software generates and stores the documents in easily accessible folders so you can always find the details whenever required.

- Real-Time Tracking: Get real-time tracking of all the processes related to income tax. You can control the complete workflow by making a few clicks from your system with the best income tax software. You can view the real-time process status of every function with customized alerts, reducing hands-on time and enabling employees to focus on higher-priority tasks.

- Better Efficiency: Helps increase the efficiency of every company's tax management process. You will be able to retrieve data, eliminate data that is not required, generate invoices, upload digital signatures, and access archived data.

- Controlled Workload: With income tax calculation software, you can save yourself from redundant tasks and focus only on the processes that need your attention. You can focus on priority tasks and manage them by viewing the real-time process status and receiving customized alerts which help in reducing hands-on time.

- Affordability: Most software is affordable and has various features that can be used for filing income tax returns and other functionalities.

- User-Friendly Features: Top income tax calculation software are easy to use and has an interface that employees can manage with limited technical expertise. There are also demo training sessions available if you want to learn how to make the most of taxation software in detail.

Benefits of Income Tax Software

Income tax software makes it easier to complete complex calculations for computing tax and adjusting deductions according to the Income Tax act. Moreover, it can also help in managing your clients' tax-related tasks. Here are some other benefits of using income tax return software:

- Precise Calculations: In addition to calculating tax, this software can also be used for calculating depreciation for various assets for a particular business or industry.

- Maintains Tax Records: When the taxation software calculates taxes and files returns, it automatically saves it in the database. Therefore, eliminating any need to save data manually.

- Easy E-Filing: Tax software saves a lot of time by letting you file tax returns and TDS returns directly from it without visiting the tax portal separately.

- Reduces Costs: The tax software can automatically file tax returns by verifying data and calculating precise tax. Therefore, it helps in reducing the costs of hiring a professional for filing returns.

How to Prepare an ITR Using ITR Filing Software?

To prepare an ITR through an ITR Filing Software, you need to follow the below steps:

Step 1: Select Form 16 from the option available in the software and add all details and documents.

Step 2: Enable automatic tax calculations for all major income sources like Salary, Capital, Property, etc.

Step 3: Enable automatic calculation of Long-term capital gain, short-term gain calculation, holding period, indexed costs, and so on.

Step 4: Select ITR forms from ITR1, ITR2, ITR3, and ITR4 based on income tax stated by the Income-tax department of India.

Step 5: Fill up all the relevant data and revise all the details and calculate tax deductions.

Step 6: Once done, generate the document in XML format and upload it on the government’s portal for eFiling.

Step 7: Complete the return verification with six available options.

Step 8: Lastly submit the form on the portal and your form will be submitted.

Top 10 Income Tax Software For Income Tax Return Filing

Here is the list of best income tax software for TDS and ITR filling:

How To Choose The Best Income Tax Software Online?

Finding the right taxation software should be based on what your organization needs. Depending on the features and modules you need, your choice of software will change. Here are a few points to consider when choosing an income tax calculation software in India.

- Identify your requirements: Identify your need as if you are looking for particular module-specific income tax calculation software with automated e-filling and a TDS module, or you need complete software with basic features.

- Ease of Use: Most income tax software are easy to use, but you must ensure that you can understand and operate the tool easily once it's implemented within your system. Any software functionality that you cannot use conveniently will result in the wastage of both time and effort.

- Vendor Support System: Reliable vendor support is necessary for you in case things go wrong. If you face any issue with the income tax return software, you will need a vendor support executive to fix it. You should make sure that your vendor has a reliable after-sales service because delays in fixing the issue can take a toll on your company.

- Get Software Demo: Before buying income tax software, you should ask for a demo. Also, make sure you inquire with the vendor about each feature. ITR software demos are quite helpful, as you can understand the software better and make a sound judgment before buying the software.

- Making the Investment: Invest only when you are sure you want to opt for offline or online income tax software. Income tax computation software price varies according to its features. If you are a beginner, you can always try your hands on the free income tax software available online.